September is historically the worst month for the US equity markets. According to Stock Traders Almanac, September is ranked 12th for Dow Jones Industrial Average, S&P 500, and NASDAQ Composite. It is the second-worst month for Russell 2000. Since 1950, the Dow has declined 42 times or 59% in September and the S&P 500 38 times or 54%.

In September 2021, the S&P 500 was down by -4.8% for the month, DJIA by -4.3%, NASDAQ Composite by -5.3%, and Russell 2000 by -3.1%. Despite this decline, the market's performance in September 2021 seems to be par for the course.

October: The Jinx Month or A Bear Killer

October ranks in the middle of the pack for major US indices. It is the seventh-best month for DJIA, S&P 500, and NASDAQ and sixth-best for Russell 2000. The average monthly return for indices ranges between +0.6% and +0.8%. It has also witnessed many market crashes, including 'Black Tuesday' on October 29, 1929, and 'Black Monday' on October 19, 1987. On October 27, 19997, DJIA declined 554 points, and in October 2008, the Global Financial Crisis picked up steam.

So no wonder October is also called the Jinx Month. Yet, it is also known as a "bear killer." An old market saying goes that September is when leaves and stocks tend to fall and that October is when many bears are killed1.

Intermarket Analysis

The four major asset classes - equities, bonds, commodities, and the Dollar index are trending up nicely on the weekly timeframes though the uptrend may be facing mild down pressure.

Treasuries Are Placed Precariously

The 30 Year US Treasury Bonds turned up in mid-March 2021 after declining from the highs that they reached in the early weeks of the pandemics (see the first pane of Fig. 1). Their turnaround happened near the previous lows created in late December 2019, which acted as a support.

The bonds are also forming a Head-&-Shoulder pattern. Their recent high - created in July-August 2021 - is looking like the right shoulder of the pattern. A break below March 2021 lows will complete the pattern.

The following support after that break is the October 2018 low, which corresponds with the 30-year Treasury yields of 3.455%.

Equities Continue to Advance

The US equities - the S&P 500 (see the second pane of Fig. 1) - are continuing their uptrend, albeit they are experiencing a retracement or a correction - the index has declined around -5.3% from its all-time high of 4545.85.

So far, the decline in September is looking like a typical seasonal market move, and the bull rally has a good chance of resuming.

Commodities Are On A Tear

The commodities, represented by the Reuters/Jefferies CRB Index (see the third pane of Fig. 1), are trending higher since April 2020. It is near 2015 high and has broken above the horizontal channel or a congestion zone that it created from mid-2016 to late-2019.

The next resistance level for the CRB index is about 20% higher than its current levels.

The Dollar Index Is Moving Up But Is In A Congestion Zone

The US Dollar index has been rising since late December 2020 (see the fourth pane of Fig. 1); however, it is still in a congestion zone between 95 and 88.

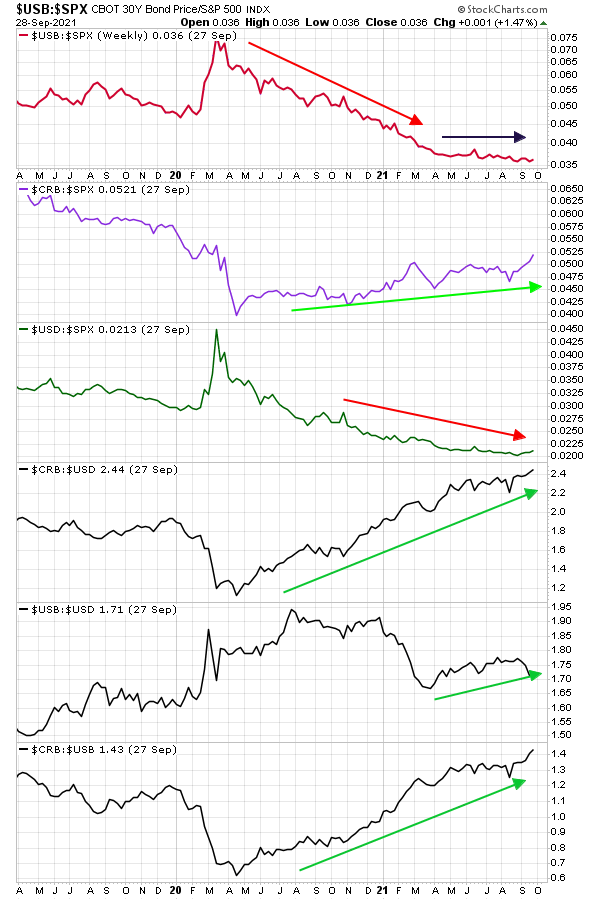

Commodities Are The Strongest Asset Class

The commodities are leading all other asset classes. They are performing slightly better than the equities (see the second pane of Fig. 2), but they are significantly outperforming the bonds (see the sixth pane of Fig. 2) and the dollar (see the fourth pane in Fig. 2) since April 2020.

Equities Are Leading The Other Two Asset Classes

The S&P 500 has been outperforming the bonds (see the first pane of Fig. 2) and the dollar index (see the third pane of Fig. 2) since April 2020 though the pace of outperformance has slowed down recently.

The US Dollar Is The Worst-Performing Asset Class

The dollar index is underperforming all other asset classes. It has been underperforming equities and commodities since April 2020 and bonds since April 2021.

Developed Markets Are Leading

The Emerging Markets, the iShares MSCI Emerging Markets ETF EEM, have been moving sideways since March 2021 after rising from the pandemic induced slump in March 2020 (see the second pane of Fig. 3). In February 2021, they made the all-time high of 58.29, which was just 4.4% above the previous high of 55.83 made in 2007. Since making the all-time high, the emerging markets have declined more than -15.7% and are approaching the bear-market territory.

The developed world - the iShares MSCI EAFE ETF, EFA, and the SPDR S&P 500 ETF, SPY - have been rising since March 2020 (see the second and the third panes of Fig. 3).

Emerging Markets Are The Worst Performers

The emerging markets are underperforming the developed markets as EEM has mostly underperformed S&P 500 since April 2018 (see the fourth pane of Fig. 3), and the pace of underperformance has increased since early 2021.

The emerging markets are also underperforming the developed market ex-US, EFA, since early 2021 (see the sixth pane of Fig. 3) though they outperformed the EFA for most of 2020.

The US equity market, SPY, has been the best index as it has been giving a higher return than both EEM and EFA for some time.

Economy Continues to Grow

The US economy continues to improve and recover from the pandemic-induced slump (see Fig. 4). Total Nonfarm Employment is again rising though it has not reached its pre-pandemic level, and the same is valid for Industrial Production. Advanced Retail Sales and Real Disposable Income, on the other hand, have surpassed their pre-pandemic levels.

The year-over-year rate of change for these indicators has slowed down (see Fig. 5). In the second and third quarters of 2021, these indicators improved rapidly as the economy reopened in the wake of the Coronavirus vaccine rollout. Since then, the rate of change has slowed. Real Disposable Income annual rate of change declined sharply from March 2021 to April 2021 and turned negative though it is again rising. Industrial Production, Retail Sales, and Real Per Capita GDP have also declined to 10%-to-5% range.

Inflation Is Heating Up

The inflation is heating up. After declining during the early months of the pandemic, inflation gauges are rising at a rapid rate (see Fig. 6). The Consumer Price Index, the Core CPI, and the Core Personal Consumption Index, Fed's preferred inflation indicator, are advancing at rates much higher than their previous many months' average rates. The rate of increase, however, has slowed down in recent months.

The inflations expectations are also rising (see Fig. 7). The University of Michigan Inflation Expectation is at the highest level since 2011. Other indicators - 5-Year, 5-Year Forward Inflation Expectation, 10-year Breakeven Inflation Rate, and 5-Year Breakeven Inflation Rate - are also at the highest levels since 2013.

Whether the inflation is transitory or not, it is here and would persist for some months. Chances of it tormenting the market and boosting the interest rates to the levels last seen in 2018 are high.

Corporate Earnings Are Rocking

The Third Quarter earnings season will be kicked off in October and is expected to be very promising for S&P 500 companies. Companies are estimated to report very healthy earnings and revenue growth. The forward guidance for earnings and revenue indicates that the fundamental outlook for S&P 500 companies is pretty robust.

Forecast For Above Average Earnings, Revenue, and Net Profit Margin

According to FactSet, the estimated earnings growth for the S&P 500 is 27.6% (see Fig. 8), which would be the third-highest growth rate since 2010 if so reported. The Q3 growth rate is revised up from 24.2%, the forecast made on June 30.

More analysts are optimistic about earnings as 56.9% of their ratings is Buy, 38.8% is Hold, and only 6.2% Sell. The average 5-year ratings for Buy are 52.0%, Hold 42.%, and Sell 6.0%, respectively.

The estimated revenue growth for the Third Quarter is 14.9%, which would be the second-highest revenue growth since 2008 if so reported. The Q3 growth is higher than its 5-year average revenue growth of 3.9%.

The Net Profit Margin is estimated to be 12.1%, below the previous quarter's record net profit margin of 13.1% but above the 5-year average of 10.9%.

Forward Guidance Looks Promising

For Q4 2021, the projected earnings growth is 21.5%, and the project revenue growth is 11.3%. For Q1 2022, the projected growth rates are 5.5% and 8.2% for earnings and revenue, respectively.

Energy, Materials, and Communications Services Shine

Energy, Materials, and Communication Services sectors are estimated to report the higher revenue and earnings growth rate for Q3 (see Fig. 9 and Fig. 10). Utilities and Consumer Staples are the laggard sectors.

Analysts have issued the highest percentage of Buy ratings for Energy (66%), Communication Services (63%), Information Technology (62%), and Health Care (62%). They are most pessimistic for Consumer Staples as it has the most Hold ratings (42%) and Sell ratings (11%).

PE Ratios Indicate Overvaluations

The forward 12-month P/E ratio for the S&P 500 is 20.8, higher than the 5-year average (18.3) and the 10-year average (6.4).

The Shiller P/E in Q3 2021 is estimated to be 38.56, higher than the 5-year average of 30.88 and the 10-year average of 32.50 (See Fig. 11). The Shiller P/E is also at the highest level since November 2000.

These two ratios indicate severe overvaluation.

Psychological

Investor's Intelligence Advisors Sentiment Survey reports that 47.1% of advisors are Bullish, the lowest level since May 2020. Correction advisors are at 30.6%, and the Bearish advisors are at 22.3%. The overall sentiments seem to be neutral.

On the retail investors’ or amateurs’ side, the latest AAII Sentiment Survey shows a rebound in bullish sentiment, which is the expectation that the stocks will rise over the next six months. It rose 7.4% to 29.9% compared to the historical average is 38.0%. Eight out of the past 11 weeks, this indicator has remained below its historical average.

The neutral sentiment - expectations that the stocks will stay essentially unchanged over the next six months - dropped to 7.3% to 30.9%, below its historical average of 31.5%. Bearish sentiment - expectations that the stocks will decline over the next six months - is at 39.2%, above its historical average of 30.5%.

The AAII sentiment survey shows that pessimism remains near the upper levels even though the readings are within their historical range.

Gathering Clouds

Some clouds are gathering on the horizon that may impact the markets' performance in October and Q4.

US Debt Ceiling and Political Environment

The United States government is in a political fight over the debt ceiling, the maximum limit that the US Treasury can borrow by cumulatively issuing bonds. Presently, the US is approaching this limit, and unless it is suspended or increased, the Treasury cannot issue any more bonds.

If the debt ceiling is not increased or suspended, then the US government will default on its debt obligations with catastrophic results for the global financial markets. The probability of a US default is extremely rare, but the delay and a prolonged drama over this process will likely spook the market.

Coronavirus Pandemic

The Delta variant of Coronavirus seems to be getting under control in the US and the developed world. The per capita rate of vaccination is also increasing. However, we are still not out of the woods, and the global economy has not yet achieved the normal levels. The handling of pandemics is still creating some level of uncertainty for the markets.

Labor Shortage and Supply Chain Breakdown

The global supply chain is out of whack for many reasons, including labor shortages, production, and manufacturing not getting back to its pre-pandemic levels. The supply-chain breakdown is harming business activities and profitability.

The China Question

The recent economic data coming out of China is not very encouraging. Data on consumption, industrial output, and PMI reveal that the post-pandemic Chinese economy is still weak. China is still dealing with the fallout of Evergrande's debt crisis. The Chinese property giant can cause Lehman-like calamity for China, and though it may not spill over the rest of the world, downside risk remains for the global markets.

Federal Reserve Is Set to Taper

The Federal Reserve is keeping the interest rate near zero, but it has indicated that it will start tapering its bond-buying programs soon. The Fed is still maintaining an accommodative stance and is not planning to raise the Fed Funds rate for many quarters, the bond markets are still getting jittery, and yields will continue to rise for some time.

In Summation

The September-October period is usually known for market doldrums, and this year it is no different. The global equity markets have been rising for many months without any significant correction. So the Technical outlook could be termed as consolidating.

The fundamental outlook for businesses remains robust and corporate earnings are projected to grow at a healthy rate, which bodes well for the equity markets.

The monetary policy is still loose, but the inflationary pressure is showing up. The upcoming tapering of the bond-purchase program is bound to generate some level of tightening.

The seasonal outlook is improving as October is when the equity markets historically stage a turnaround following the slow-down and decline of summer and early fall.

Psychological indicators are contrarian at their extremes but not so when they are within their historical ranges. Most of these indicators are within their normal range, implying that the overall market sentiments remain neutral.

Stock Trader’s Almanac